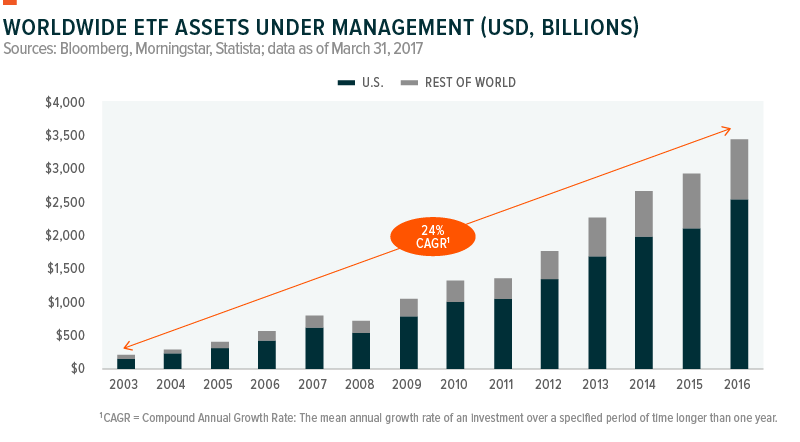

The US spot Bitcoin ETF market is experiencing a remarkable surge, driven by recent Federal Reserve rate cut announcements. Institutional investors are eager to capitalize on the opportunity, leading to a staggering $495 million in inflows in a single day last Friday, which pushed the weekly total to over $1 billion. This influx highlights the growing interest in Bitcoin ETFs, particularly with BlackRock ramping up its holdings in its own ETF, IBIT. ETF market is large…

Surging Demand for Spot Bitcoin ETF Market

The demand for spot Bitcoin ETFs has skyrocketed in the wake of the Fed’s decision to cut interest rates, with inflows consistently rising supported by high trading volumes. This week alone, regulated ETF products have acquired over 17,009 BTC, underscoring robust institutional participation in Bitcoin investments.

Ark Invest’s ARKB is leading the charge for the second consecutive day, with over $203 million in inflows recorded on Friday. Following closely is Fidelity’s FBTC, which attracted $123 million, while BlackRock’s IBIT brought in $111.7 million, according to data from Farside Investors. Together, these three players withdrew 6,661 Bitcoins from the open market on that day, illustrating the growing appetite for Bitcoin among institutional investors.

When comparing these figures to the daily production of Bitcoin, which stands at approximately 450 BTC, the demand from these ETFs is notably high. Along with the 17,000 BTC absorbed by these exchange-traded funds, MicroStrategy also added 7,000 BTC to its holdings this week, further intensifying the competition for available Bitcoin.

The Impact on Bitcoin Prices

This surge in ETF market demand has significant implications for Bitcoin’s price, which has increased by about 5% over the past week. As of the latest update, BTC is trading at $66,071.29, reflecting a 1.16% rise and a market cap of approximately $1.305 trillion. The anticipation of a bull run in Q4 2024 has investors actively positioning themselves in the market, contributing to upward momentum in Bitcoin’s price.

BlackRock’s Strategic Purchases

BlackRock, the world’s largest asset manager, has been particularly aggressive in its Bitcoin acquisition strategy, offering strong support for the cryptocurrency as a viable asset class. The firm views Bitcoin not only as an investment but also as a hedge against rising inflationary pressures.

Recent SEC filings indicate that BlackRock has been purchasing additional shares of its spot Bitcoin ETF, IBIT, as part of its global allocation fund. As of July 31, the asset manager reported holding 198,874 shares of IBIT, a significant increase from the 43,000 shares it owned in June. This steady accumulation demonstrates BlackRock’s commitment to Bitcoin as a long-term investment.

Since its launch, BlackRock’s BTC ETF has attracted more than $21.3 billion in inflows over the past nine months, solidifying its dominance in the market. The continued interest from institutional players like BlackRock not only enhances Bitcoin’s credibility but also drives up demand, reinforcing its status as a sought-after asset.

The Broader Implications for the Crypto Market

The rapid growth of the spot Bitcoin ETF market is indicative of broader trends within the cryptocurrency landscape. As institutional investors increasingly turn to Bitcoin as a stable and lucrative investment option, it signals a maturing market that is gaining acceptance among traditional finance players.

The influx of capital into Bitcoin ETFs may lead to greater liquidity and stability in the crypto market, fostering an environment conducive to further innovation and development. As more financial institutions enter the space, the potential for Bitcoin and other cryptocurrencies to integrate into mainstream finance becomes increasingly feasible.

Spot Bitcoin ETF Market Sees $1 Billion in Weekly Inflows, Signaling Rapid Growth

Conclusion: The Future of Bitcoin ETFs

The US spot Bitcoin ETF market is on the cusp of a significant transformation, marked by substantial inflows and growing institutional interest. As demand continues to rise, fueled by strategic purchases from major players like BlackRock and the anticipation of a bull market, the future of Bitcoin looks promising.

Investors are keenly observing these developments, with many believing that Bitcoin’s upward trajectory is just beginning. As the market evolves, it will be essential to monitor how these trends shape the broader cryptocurrency ecosystem and influence Bitcoin’s position as a leading digital asset.

In summary, the combination of increased ETF market inflows, institutional participation, and strategic acquisitions sets the stage for a potentially explosive Q4 in the cryptocurrency market. As more investors look to Bitcoin for long-term growth and stability, its relevance in the financial landscape continues to solidify.