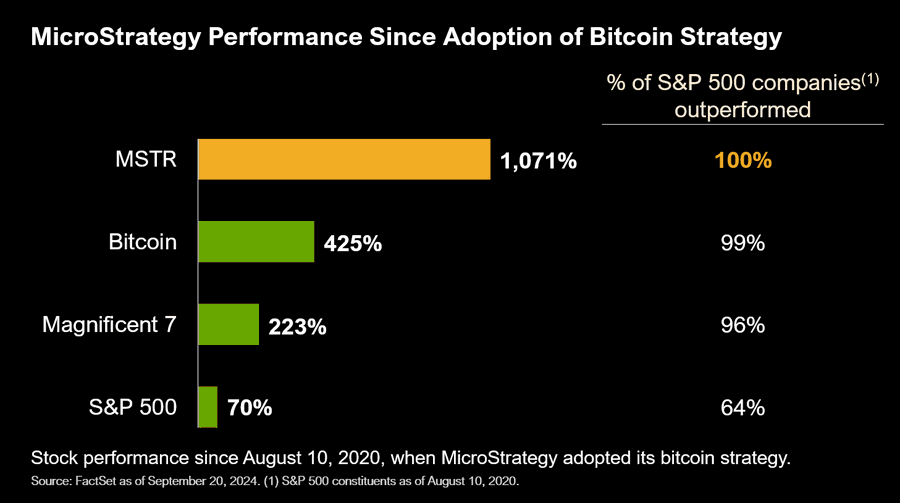

Since MicroStrategy’s decision to adopt Bitcoin in 2020, its stock (MSTR) has outperformed all other companies in the S&P 500. The company’s continued accumulation of Bitcoin, spearheaded by its former CEO and co-founder Michael Saylor, has significantly contributed to this remarkable performance. MicroStrategy’s decision to embrace Bitcoin as part of its strategy has proven to be highly beneficial for the company’s stockholders.

In a social media post, Saylor highlighted how well MSTR stock has performed since the company began purchasing Bitcoin. According to the data he shared, MSTR has outperformed 100% of the companies listed in the S&P 500 during this period. This performance highlights the impact of the company’s bold strategy of aligning itself with the Bitcoin market.

MSTR Stock’s Performance Since MicroStrategy Bitcoin Adoption

MicroStrategy‘s approach has been unique among traditional software companies, focusing not just on its core business but also on cryptocurrency as a significant part of its financial strategy. Since 2020, MicroStrategy has continued to accumulate Bitcoin, making it one of the largest corporate holders of the cryptocurrency. This aggressive accumulation has paid off, as the company’s stock has surged alongside Bitcoin’s overall rise in value during the same time frame.

The move to invest in Bitcoin has made MicroStrategy stand out within the tech industry, setting an example for how corporations can integrate cryptocurrency into their long-term financial strategies. The success of MSTR stock since adopting Bitcoin demonstrates the potential rewards of such a forward-looking and unconventional approach.

Interestingly, the MSTR stock price has also outperformed Bitcoin over the last four years. Since MicroStrategy Bitcoin adoption, the company’s stock has surged by over 1,000%. Meanwhile, BTC and the S&P 500 have surged by 425% and 70%, respectively.

MicroStrategy’s co-founder, Michael Saylor, pushed for the software company to begin buying the flagship crypto, and his bet on BTC has undoubtedly paid off. Thanks to this Bitcoin strategy, many institutional investors have long regarded the company as an avenue to gain exposure to the flagship crypto. This explains how the MSTR stock has achieved such immense growth.

There were projections that MicroStrategy was going to lose its Bitcoin edge following the launch of the Spot Bitcoin ETFs. However, that hasn’t been the case, with MSTR boasting a year-to-date (YTD) gain of over 120%.

Meanwhile, MicroStrategy Bitcoin adoption has continued to grow. The company recently bought 7,420 BTC ($458.2 million). Before this purchase, it had also bought $1.11 billion worth of Bitcoin, its single largest buy to date. The firm currently holds 252,220 BTC at an average price of $39,266 per Bitcoin.

Michael Saylor Expects Institutional Adoption To Grow

Michael Saylor recently stated that the approval of options trading for BlackRock’s Spot Bitcoin ETF will “accelerate” Bitcoin adoption. The U.S. Securities and Exchange Commission (SEC) approved options for the IBIT ETF on the Nasdaq exchange, a move expected to grow the Bitcoin ETF market and attract more institutional investors, aligning with Saylor’s prediction.

Bloomberg analyst Eric Balchunas echoed this view, emphasizing that options trading will “attract more liquidity,” which in turn will draw in larger investors. The introduction of options provides more flexibility for institutional investors, making the Bitcoin market more accessible and appealing to a broader range of financial players.

Binance CEO Richard Teng also commented on the increasing institutional adoption of crypto, suggesting that what has been seen so far is just the beginning. According to Teng, more institutional investors are likely to enter the space as they finish their due diligence. His perspective aligns with Saylor and Balchunas, indicating a strong belief in the potential for continued growth in institutional interest in Bitcoin and other cryptocurrencies.

The combination of these developments reflects a growing consensus that institutional adoption is poised to increase significantly. With new financial products like options for Bitcoin ETFs, the market is becoming more structured and attractive to large-scale investors. As institutions allocate more resources to Bitcoin, this could further legitimize cryptocurrency as an asset class, boosting both its liquidity and market presence. The recent changes suggest that the growth in institutional interest may only be at its early stages, with more to come in the near future.