Business intelligence company MicroStrategy announced on Friday that it has acquired 18,300 BTC for approximately $1.11 billion, according to a filing with the US SEC. Following this purchase, the company’s total Bitcoin holdings have risen to 244,800 BTC, as stated by Michael Saylor, executive chairman of Micro Strategy. This acquisition marks one of the largest Bitcoin purchases made by the firm to date. As a result of this significant investment in cryptocurrency, MicroStrategy’s MSTR stock price rose by 0.65% in premarket trading. The company’s ongoing commitment to accumulating Bitcoin underscores its strategy to leverage cryptocurrency as a key asset on its balance sheet. With increasing institutional interest in Bitcoin and its potential for long-term value appreciation, Micro Strategy continues to position itself as a leader in the corporate adoption of cryptocurrency. This latest acquisition reinforces the firm’s bullish outlook on Bitcoin’s future growth and market potential.

MicroStrategy Acquires Another 18,300 BTC

In a recent post on the X platform dated September 13, MicroStrategy’s Executive Chairman Michael Saylor announced that the company has significantly increased its Bitcoin (BTC) holdings. As the largest corporate holder of Bitcoin, MicroStrategy acquired 18,300 BTC valued at $1.11 billion, according to an SEC filing.

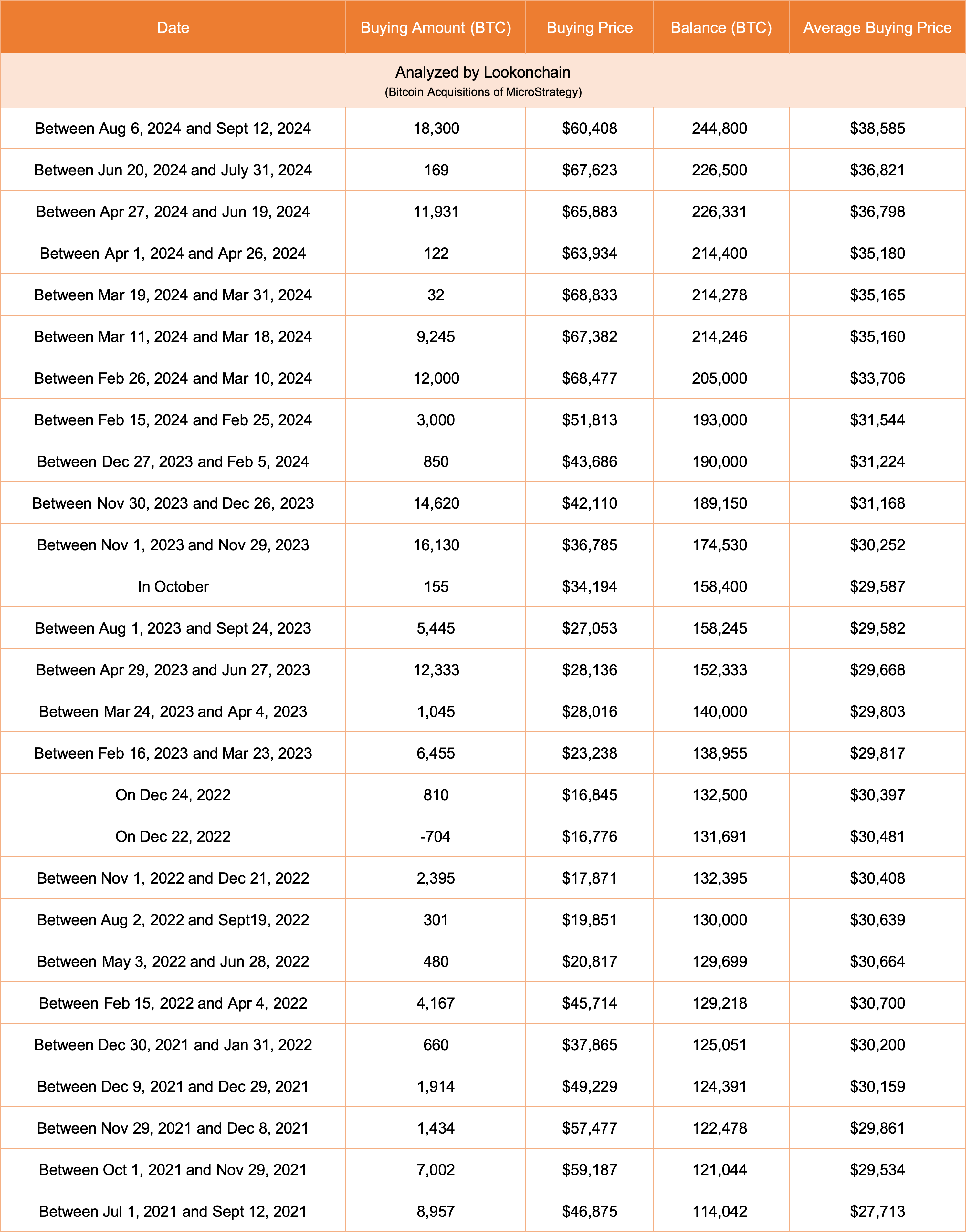

With this latest acquisition, MicroStrategy has raised its total BTC holdings to an impressive 244,800 BTC, amounting to a total value of $9.45 billion. This means the company has an average acquisition cost of approximately $38,585 per BTC. Additionally, the firm has reported a BTC yield of 4.4% for the quarter-to-date (QTD) and an impressive 17.0% yield year-to-date (YTD). According to data from Lookonchain, MicroStrategy’s current profit stands at $4.71 billion, highlighting the significant returns on its Bitcoin investments.

This continued investment strategy reinforces MicroStrategy’s commitment to Bitcoin as a vital asset on its balance sheet. As institutional interest in cryptocurrency grows, the company’s strategy to accumulate Bitcoin positions it favorably in the evolving digital asset landscape. Michael Saylor’s leadership and vision for Bitcoin have made Micro Strategy a pivotal player in the corporate adoption of cryptocurrency. As the market evolves, MicroStrategy’s actions will be closely watched by investors and industry analysts alike, further solidifying its role as a leader in Bitcoin investments.

In June, MicroStrategy acquired 11,931 bitcoin from a $800 million private offering of convertible senior notes. The company said it intended to use the proceeds primarily to purchase additional Bitcoin, aligning with its ongoing strategy of leveraging debt to expand its cryptocurrency holdings. Meanwhile, the convertible senior notes are unsecured and senior, meaning they rank higher in claim priority over other debt but lack collateral backing.

MSTR stock price is volatile during the premarket hours after MicroStrategy revealed the BTC purchase. MSTR stock price is up just 0.21% at $131.05 on Friday.

Michael Saylor Fails to Move Bitcoin Price

In June, Micro Strategy acquired 11,931 Bitcoin using proceeds from an $800 million private offering of convertible senior notes. The company stated that it intended to utilize these funds primarily to purchase additional Bitcoin, reinforcing its strategy of leveraging debt to increase its cryptocurrency holdings. The convertible senior notes are unsecured and senior in nature, meaning they have a higher claim priority over other debts but are not backed by any collateral.

Following the announcement of this Bitcoin purchase, Micro Strategy’s MSTR stock price exhibited volatility during premarket hours. On Friday, the stock was up 0.21%, trading at $131.05. This slight increase reflects investor reactions to the company’s continued commitment to Bitcoin, positioning MicroStrategy as a leader in corporate cryptocurrency investments. The strategy of acquiring Bitcoin through debt financing demonstrates MicroStrategy’s confidence in the long-term value of the asset, despite market fluctuations. As institutional interest in cryptocurrencies continues to grow, MicroStrategy’s bold moves in the market will likely attract attention from both investors and analysts, highlighting its role in shaping the future of corporate Bitcoin adoption.